Global Cookers & Ovens Market Size, Share & Industry Trends Analysis Report By Distribution Channel (Offline and Online), By Type (Cooktops & Cooking Ranges, Ovens, and Cookers), By Regional Outlook and Forecast, 2022 - 2028

Special Offering:行业的洞察力s | Market Trends | Highest number of Tables | 24/7 Analyst Support

Get in-depth analysis of the COVID-19 impact on the Cookers & Ovens Market

Market Report Description

The Global Cookers & Ovens Market size is expected to reach $220.1 billion by 2028, rising at a market growth of 5.7% CAGR during the forecast period.

A range cooker has a roasting or baking oven as well as a stove for boiling or frying. It is freestanding, which implies it can be moved around the kitchen and does not involve any cabinetry installation. It's the most prevalent type of range cooker in the market. This is because it isn't attached to a wall or structure, the consumer can relocate it or reorganize the kitchen. Ovens are commonly utilized for cooking because it can heat food to a specific temperature. Ovens are also utilized to make pottery and ceramics, and the ovens are often called kilns. Metallurgical furnaces are utilized to manufacture metals, while glass furnaces are used to manufacture glass.

Various sorts of ovens generate heat in a variety of ways. Some ovens heat items by burning fuel like coal, wood, or natural gas, while others use electricity. Microwave ovens heat materials by introducing it to microwave radiation, whereas resistive heating is used in electric furnaces and electric ovens. Some ovens employ forced convection, or the movement of gases within the heating chamber, to speed up the heating process or, in some situations, to alter the elements of the material being heated, as in the Bessemer steel-making method.

The cooker and oven market is driven by raising awareness of the benefits of renewable energy, rising non-renewable energy prices as well as multiple aids by government assistance and subsidies for the usage of solar energy. The need for solar cookers is also fueled by the development of new technologies that use solar energy, as well as the introduction of cost-effective solutions when compared to traditional energy sources.

COVID-19 Impact Analysis

The coronavirus pandemic has had a negative impact on the global economy. Lockdown orders were issued by governments all around the world to prevent the spread of SARS-CoV-2. This had a huge impact on trade and development, as well as offline distribution channels and the supply chain for cookers and ovens. Although, the market has since recovered and is on the mend, due to ongoing demand for a variety of kitchen appliances, such as cookers and ovens. As an outcome of the coronavirus pandemic, exporters in both advanced and emerging nations have encountered numerous challenges. The issues experienced by exporters of oven items are predicted to endure in the coming years as numerous states and governments around the world attempt to tackle COVID-19 using various means.

Market Growth Factors

Growing disposable income of the consumers is propelling the market

可支配收入的激增推动需求or large cooking appliances across a variety of business sectors, including modular homes. Large kitchen equipment is becoming increasingly popular among customers as people's lives change with their high disposable income. Due to change in lifestyle of people and increasing inclination of consumers towards cooking, there is a growth in demand for kitchen equipment among household end-users. Consumers with more disposable income are investing in the purchase of better kitchen equipment.

Lower time is taken in the cooking process

在当前generation, people cannot afford to spend significant time in preparation and cooking the food. Hence, cookers and ovens make the cooking job easier for people by drastically reducing the time without compromising with quality of cooking. People want to continue with home-cooked food but are unable to do it just because of the stringent life routine, along with that, time spent on cooking is a huge concern for working population. The cookers and ovens combine two or more heat sources, such as infrared, microwave, and high impinged hot air, which can reduce cooking time. This is one of the reasons for adopting this cooking appliance with cutting-edge technologies. Additionally, by minimizing the time spent cooking, cookers and ovens allow restaurants to provide food on time.

Market Restraining Factors

Involvement of Higher cost in purchase and maintenance of ovens

Certain kind of cookers and ovens have more advanced functions, it is more expensive than other cooking appliances. It is because of the availability of different alternatives to ovens and cookers with comparable features and low prices. Moreover, cookers and ovens require regular maintenance, which comes at a cost. It is because not all consumers can buy such expensive items, consumers opt for an alternative with similar qualities. Since cookers and ovens are meant to cook food quickly, it may require more power to run, resulting in a high electricity bill.

Distribution Channel Outlook

Based on Distribution Channel, the market is segmented into Offline and Online. The offline segment witnessed the highest revenue share in the cookers and ovens market in 2021. The increased demand for micro-ovens in developing nations will aid in the expansion of the kitchen appliance distribution and reseller network, and eventually boost the cookers and oven market. Local retailers of household appliances offer a diverse range of portable and non-portable cookers and ovens, as well as long-term customer ties. Product makers' supportive actions to ensure an efficient sales margin for offline outlets would fuel the growth of the segment.

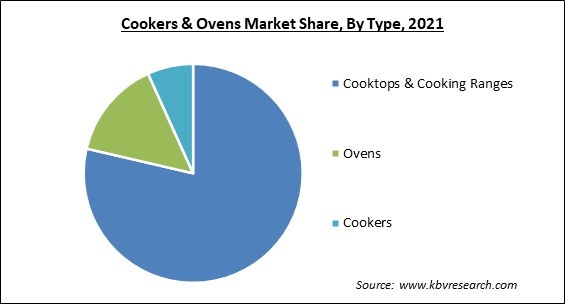

Type Outlook

Based on Type, the market is segmented into Cooktops & Cooking Ranges, Ovens, and Cookers. The cookers segment garnered a promising revenue share in the cookers and ovens market in 2021. The increased usage of multi-burner stoves, which make cooking easier, would contribute to the segment's growth. Moreover, cookers come in a variety of sizes, based on the intended use, the size of the kitchen, and the needs of the customers. In the market, hot air grilling-based cookers are extremely popular within consumers.

| 报告Attribute | Details |

|---|---|

| Market size value in 2021 | USD 151 Billion |

| Market size forecast in 2028 | USD 220.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.7% from 2022 to 2028 |

| Number of Pages | 148 |

| Number of Tables | 249 |

| 报告coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific emerged as the leading region in the cookers and ovens market with the largest revenue share in 2021. Consumer demand for convection microwave ovens in India and China is expanding, as there is a tendency in Japan to adopt motorized rotisseries with food-locking capability in ovens, the increasing need for enameled cavity-based cookers in China, and the growing preference for 4D hot air-based ovens in India.

Free Valuable Insights:Global Cookers & Ovens Market size to reach USD 220.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Haier Smart Home Co., Ltd. (Haier Group Corporation), Samsung Electronics Co., Ltd. (Samsung Group), LG Electronics, Inc. (LG Corporation), Robert Bosch GmbH, Groupe SEB, Wilh. Werhahn KG (ZWILLING J.A. Henckels AG), Koninklijke Philips N.V., Fissler GmbH, and Electrolux AB.

Recent Strategies Deployed in Cookers & Ovens Market

- mar - 2022:三星电子推出三星NQ7000B and NV7000B Oven series cooking appliances, comprising more than a single oven that comes with different features that promote healthy eating. This product launch aimed to bring unique methods to steam and air fry food to promote healthy eating, comprising: Air Frying Food, Steaming Food, and Air Sous Vide.

- Jan-2022: GROUPE formed a joint venture with Preciber, a family company in Morocco, under the name, Groupe SEB Maroc. This joint venture aimed to import and distributes exclusively Groupe SEB products in Morocco, along with providing Express brand pressure cookers in modern distribution.

- Dec-2021: LG Electronics introduced the latest cooking appliances at CES 2022, the LG InstaView Double Oven Gas Slide-in Range and Over-the-Range Microwave Oven. This product launch aimed to smooth unification with the LG ThinQ, multifunctional cooking with features like air Fry, ProBake Convection, and Air Sous Vide. Over the Range Microwave oven provides features like LG's ProBake Convection technology, LG's notable InstaView technology, ProBake Convection, etc.

- Mar-2021: Samsung Electronics released a new Baker Series microwaves, a kitchen appliance range. This product launch aimed to encourage young millennials who aspire to be home chefs and are incorporating healthy eating habits. Baker Series Microwaves include features like steaming, frying, and grilling with pro-level convection features.

- Feb-2020: Samsung Electronics unveiled a new Infinite Cooking range. This product launch aimed to enable users to cherish complete cooking control while also gaining from the numerous benefits of being able to cook many dishes in a single oven. The agility of the Infinite Cooking range proves helpful in a broad range of daily situations. Wi-Fi capabilities and a compatible smartphone app provide even greater ease of use, offering remote oven monitoring and control, unmatchable functionality with high-end design, easy maintenance, and higher convenience heating numerous pans at various temperatures. The Infinite Cooking Range includes an oven, available in two colorways, and a Combi-hob, with new Dual Cook Steam technology.

- May-2019: Koninklijke Philips introduced Philips HD6975/00, a new oven toaster griller (OTG) category. This product launch aimed to aid the consumer to make various kinds of recipes in a faster, simple, and healthy manner.

- Mar-2019: Electrolux introduced a brand new Electrolux kitchen range, built with a Scandinavian design. The new range includes Electrolux 900 CookView oven, Multi-functional 900 SteamPro oven, Electrolux 700 Hob2Hood hood, Electrolux 900 SensePro hob, Electrolux 800 MultiSpace, and 900 ComfortLift dishwashers. This product launch aimed to provide a smooth aesthetic with a focus on detail and ergonomics, creating the products intuitive to understand and use comprising ovens, hobs, freezers, fridges, dishwashers, and hoods.

Scope of the Study

Market Segments Covered in the Report:

By Distribution Channel

- Offline

- Online

ByType

- Cooktops & Cooking Ranges

- Ovens

- Cookers

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Haier Smart Home Co., Ltd. (Haier Group Corporation)

- Samsung Electronics Co., Ltd. (Samsung Group)

- LG Electronics, Inc. (LG Corporation)

- Robert Bosch GmbH

- Groupe SEB

- Wilh.Werhahn KG (ZWILLING J.A. Henckels AG)

- Koninklijke Philips N.V.

- Fissler GmbH

- Electrolux AB

Unique Offerings from KBV Research

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Related Reports:

North America Cookers & Ovens Market Report 2022-2028

Europe Cookers & Ovens Market Report 2022-2028

Q1.

What would be the value of the global cookers & ovens market by 2028?

The global cookers & ovens market size is expected to reach $220.1 billion by 2028.

Q2.

What are the key driving factors and challenges in the cookers & ovens market?

Growing disposable income of the consumers is propelling the market are driving the market in coming years, however, involvement of higher cost in purchase and maintenance of ovens growth of the market.

Q3.

Who are the top market players in the cookers & ovens industry?

Haier Smart Home Co., Ltd. (Haier Group Corporation), Samsung Electronics Co., Ltd. (Samsung Group), LG Electronics, Inc. (LG Corporation), Robert Bosch GmbH, Groupe SEB, Wilh. Werhahn KG (ZWILLING J.A. Henckels AG), Koninklijke Philips N.V., Fissler GmbH, and Electrolux AB.

Q4.

At what CAGR is the cookers & ovens market estimate to grow in the forecast period?

The expected CAGR of the cookers & ovens market is 5.7% from 2022 to 2028.

Q5.

Which segment shows a high revenue share of the cookers & ovens market in 2021?

The Cooktops & Cooking Ranges segment acquired maximum revenue share in the Global Cookers & Ovens Market by Type in 2021, thereby, achieving a market value of $170.3 Billion by 2028.

Q6.

Which region dominated the cookers & ovens market in 2021?

The Asia Pacific market dominated the Global Cookers & Ovens Market by Region in 2021, thereby, achieving a market value of $78.9 Billion by 2028, growing at a CAGR of 6.1 % during the forecast period.